Top articles

- 99% alumina bulletproof ceramics are the preferred materials for protective devices

- High-purity 99.7% alumina ceramics helpful to semiconductor manufacturing technology

- Alumina Ceramic Grinding Balls: High-Efficiency Solutions for Industrial Grinding

- How to Select Suitable Wear-Resistant Ceramic Lining Tiles in the Mining Industry

- Advantages of Ceramic Rubber Composite Liners in Industrial Applications

- How to Install Alumina Ceramic Liners for Long-Lasting Adhesion?

- Alumina Ceramic Substrates:Characteristics,Advantages,Disadvantages,and Applications

- Why do alumina industrial ceramics wear out?

- The reason of abrasion resistant ceramic tiles falling off when pasted on equipment

- Seven aspects of advantages & applications of alumina ceramic substrates

Latest articles

- 99% alumina bulletproof ceramics are the preferred materials for protective devices

- High-purity 99.7% alumina ceramics helpful to semiconductor manufacturing technology

- Alumina Ceramic Grinding Balls: High-Efficiency Solutions for Industrial Grinding

- How to Select Suitable Wear-Resistant Ceramic Lining Tiles in the Mining Industry

- Advantages of Ceramic Rubber Composite Liners in Industrial Applications

- How to Install Alumina Ceramic Liners for Long-Lasting Adhesion?

- Alumina Ceramic Substrates:Characteristics,Advantages,Disadvantages,and Applications

- Why do alumina industrial ceramics wear out?

- Chemshun Ceramics Chinese New Year Holiday Notice

- The reason of abrasion resistant ceramic tiles falling off when pasted on equipment

Your browsing history

Anglo American may fully exit Brazil — report

Beleaguered Anglo American (LON:ALL) is said to be planning a complete exit from Brazil, where the company has already put its $1 billion niobium and phosphate business up for sale.

First-round bids for those assets are due on Feb. 15, date that — reports local newspaper O’Globo (in Portuguese) — may bring some major surprises. According to veteran columnist Angelmo Gois, Anglo is also seeking to sell its Barro Alto nickel mine, as well as the vast Minas-Rio iron ore complex, which came into production last year, just as prices for the steelmaking ingredient spiralled toward historic lows.

Last week, Anglo said it was revising its production strategy for Minas-Rio to ensure lower operating costs, without given further details or mentioning any potential plans to sell the asset.Other than its $1 billion niobium and phosphate business, already up for grabs, Anglo is said to be mulling the sale of its Barro Alto nickel mine, and the vast Minas-Rio iron ore complex.

The mine had been plagued by delays and cost overruns since Anglo bought it for $5.5 billion in two stages in 2007-2008.

A company's spokesperson told MINING.com that Anglo will set out its detailed portfolio plans in mid-February. In the interim, it would wrong to speculate about it, he said, adding that the firm had no further comments on the matter.

BHP spin-off South32 (ASX, LON, JSE:S32) is said to be among the bidders for Anglo’s niobium and phosphate assets. According to local reports, the mining giant is seeking to complete such sale in one transaction, rather than splitting them.

The assets up for sale are set to make Anglo the world’s second-largest producer of niobium, a material used in high-temperature alloys for jet engines and lightweight steel for cars, when it completes its $325 million Boa Vista Fresh Rock plant, located in Brazil’s Goias state, later this year.

It produced 2,934 metric tons of niobium in the first half of 2015, and the business contributed $35 million to earnings before interest, taxes, depreciation and amortization. The phosphates unit had output of 513,000 tons with Ebitda of $52 million.

Drastic times, drastic measures

The assets sales come as Anglo American undergoes a major restructuring aimed to improve its balance sheet. This strategy has included putting offloading several mines in the last few months, from copper mines in Chile to Australian coal assets and its platinum business in South Africa.

Last month, the company finally completed its exit from the Middle East by selling its Tarmac business to Colas Moyen Orient, a subsidiary of French engineering and construction company Bouygues Group.

Anglo American, which plans to consolidate its business into three units from the current six, will be “a very different company” after it follows through on the restructuring plan, chief executive Mark Cutifani promised in December, as he unveiled the firm’s "radical portfolio restructuring."

Such reorganization includes reducing its total workforce from 135,000 to just 50,000 by 2017.

The miner became the second-worst performer in the FTSE 100 after Glencore (LON:GLEN) in 2015. It has lost about 76% of its value in the past year.

Information about "Industry News "

- Weldable tile and Its Installation

- Factors affected the proerty of wear resistant ceramics

- Abrasion resistant ceramic wear tile liner used in the milling system shows good prospects for development

- The reason why abrasion resistant ceramic lined pipe is so popular ?

- World's largest mining project takes $1 billion hit

- Is ceramic liner applied in temperature 280 degree ?

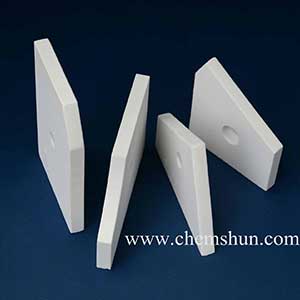

- Chemshun Wear-resistant alumina ceramic liner

- China shutting another 4,300 coal mines

- BHP takes largest-ever write-down on US shale operation

- Rio Tinto freezes all pay for 2016 as commodities rout bites